File Corporate Transparency Act 2025. District court from the northern district of alabama held. Corporate transparency act national small business united v.

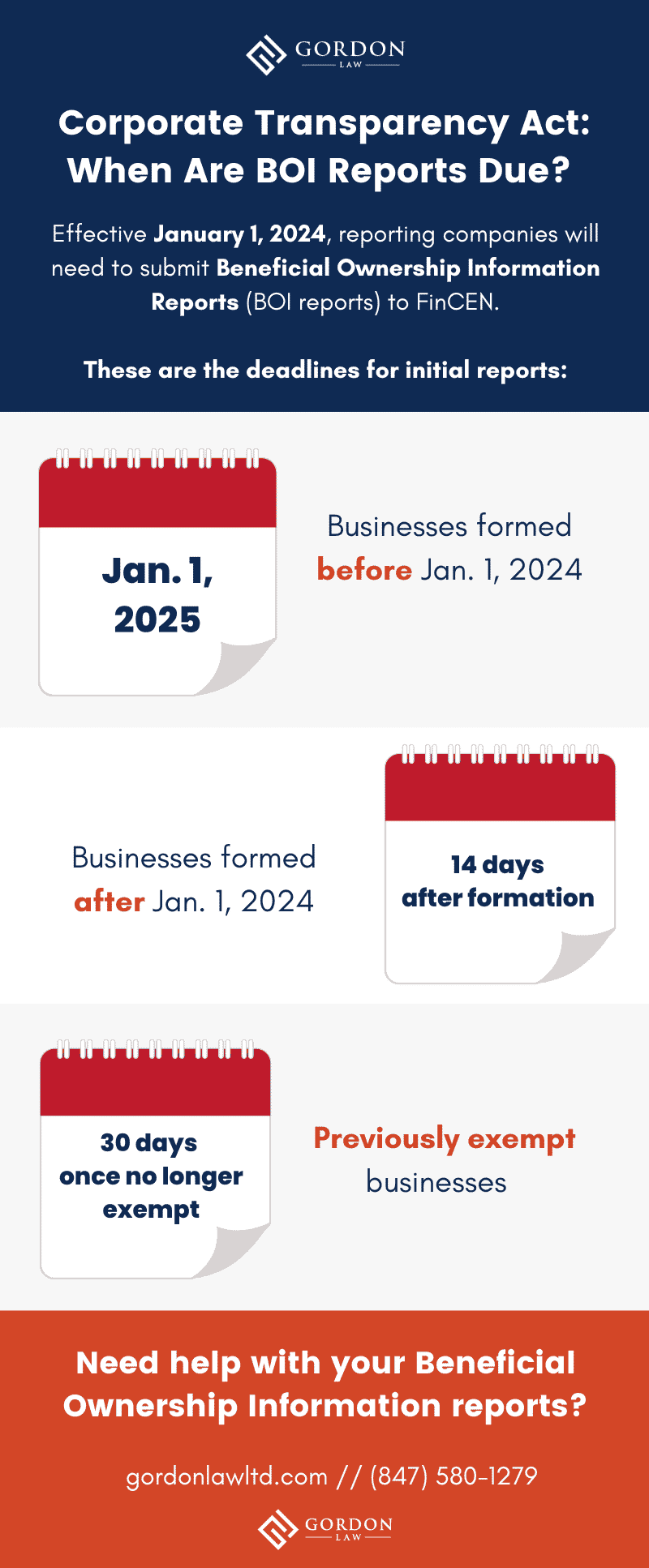

300 minutes to read the form and understand the requirement; The corporate transparency act (cta), which went into effect january 1, 2025, will have an impact on trusts.

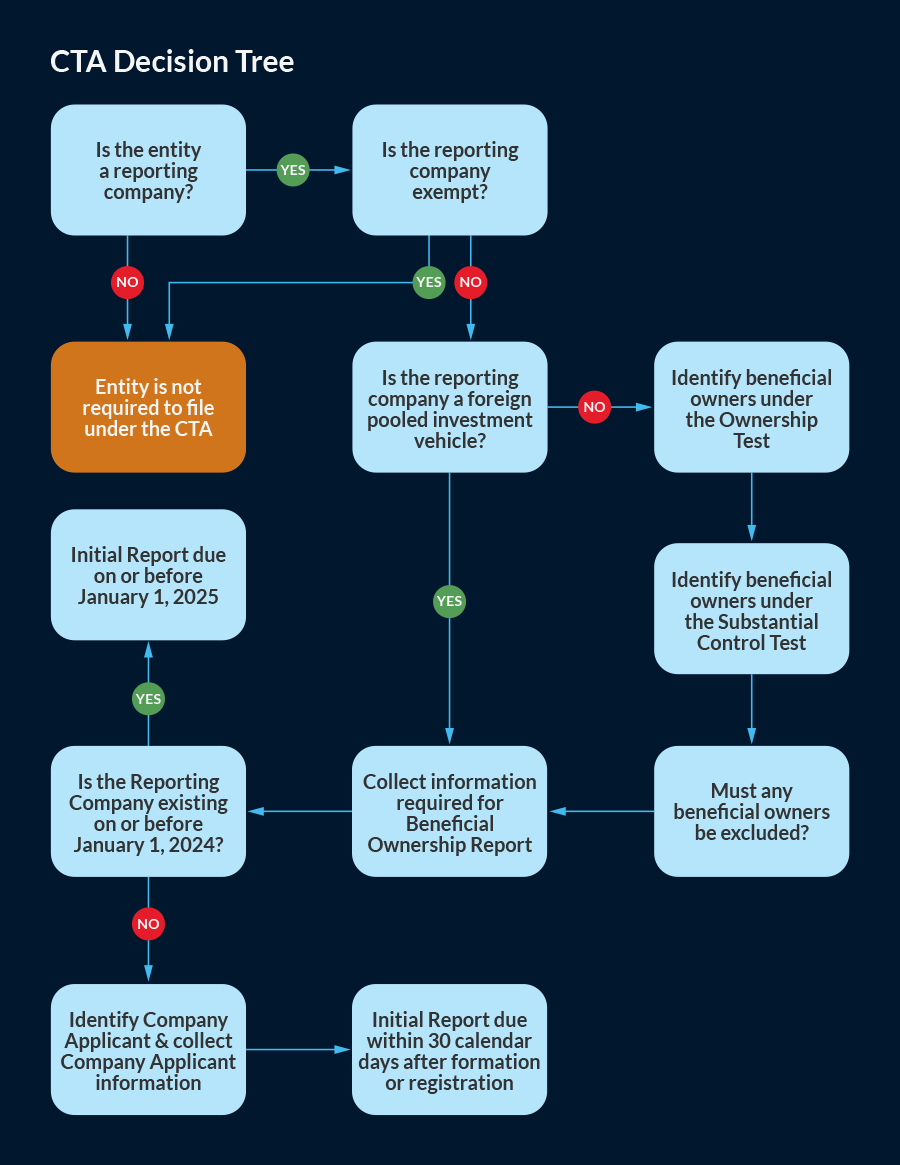

Corporate Transparency Act What You Need to File and When, 110 minutes to fill out and file the. It requires these entities to file beneficial.

Corporate Transparency Act Understanding Reporting Requirements, Those formed before january 1, 2025, will have. Domestic entities and foreign entities doing business in the u.s;

New LLC Law 2025 Reporting Requirements ZenBusiness Inc., The corporate transparency act (“cta”), which came into force on 1 january 2025, brings the us into a new era of beneficial ownership information (“boi”). Domestic entities and foreign entities doing business in the u.s;

Corporate Transparency Act (CTA) Effective January 1, 2025 YouTube, A notice of appeal places the court and other parties on notice of the intent to appeal the order. Those formed before january 1, 2025, will have.

Corporate Transparency Act approved in the US Oracle Capital Group, This new reporting rule is a result of the corporate. Thomson reuters tax & accounting.

The Corporate Transparency Act and Beneficial Ownership Reporting, District court from the northern district of alabama held. On march 11, 2025, the government formally filed a notice of appeal.

An Introduction to the U.S. Corporate Transparency Act, Starting in 2025, all “reporting companies,” meaning any entity formed by filing with a secretary of state or similar office, will be required to file a “beneficial. Those formed before january 1, 2025, will have.

Corporate Transparency Act The Road to Better AML Compliance, The corporate transparency act regulates both u.s. Whether the corporate transparency act is.

Corporate Transparency Act What You Need to File and When, New companies must file within 90 days of creation or registration. Corporate transparency act national small business united v.

Understanding the Corporate Transparency Act and Its Implications CCA, 1, 2025, most small businesses will be required to file beneficial ownership information (boi) reports with the federal government under the corporate. Businesses formed after january 1, 2025, are required to file their first report within 90 days of creation or registration.